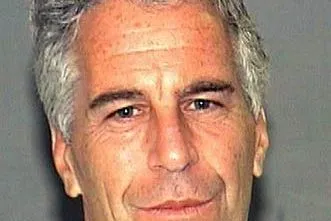

Newly released documents from the Jeffrey Epstein case reveal Panama’s role in the late financier’s exploration of offshore financial structures. The so-called Epstein Files show email discussions in 2011 about using a Panamanian entity to purchase a luxury apartment in Rio de Janeiro. These records illustrate how Epstein and his associates considered jurisdictions like Panama to minimize taxes and obscure money flows for clients.

The documents, reviewed by investigators, include a March 2011 email exchange between Epstein and Peter Mandelson, then the British ambassador to Washington. Their conversation centered on creating a fiscal structure in Panama specifically to facilitate the property acquisition in Brazil. The plan aimed to leverage Panama’s status as an offshore financial centre to reduce tax liabilities in both Brazil and the United Kingdom.

In the correspondence, Mandelson outlined the potential tax advantage.

“The company would be subject to a 2% tax on the purchase of the property [instead of 4% and 6% in Brazil and the UK],” wrote Mandelson. [Translated from Spanish]

While the files do not confirm whether this specific scheme was executed, they establish a clear pattern of seeking Panamanian vehicles for financial operations.

Complex Offshore Networks Identified

One Panamanian foundation named in the files is Opus Futurus Foundation. It is listed as the owner of Ferbel Group of Companies SLU, a Spanish holding company with subsidiaries across the United States, Switzerland, and several Latin American and Asian nations. The foundation was established by Juan Fernando Belmont Anderson, a businessman linked to the Latin American fragrance and cosmetics sector.

Internal bank forms from Deutsche Bank described this network as having “multiple layers of ownership.” Due to its complexity and international reach, the structure was flagged for enhanced Know Your Customer (KYC) reviews. This particular network appears within the same set of financial archives examined in the epstein files investigation.

The mention of Panama also connects to Epstein’s business circles in New York. Previous revelations from the Panama Papers had linked the firm Cantor Fitzgerald to offshore entities. Howard Lutnick, the head of Cantor Fitzgerald, was Epstein’s neighbor in Manhattan. His firm is cited in FBI statements as part of opaque financial circuits examined by authorities.

Banks Flagged High-Risk Structures

Banking records within the files show several client relationships involving Panamanian foundations were marked as “high risk” by internal compliance systems. These profiles typically involved foundations in Panama controlling holdings in Europe with linked accounts in the United States. Monitoring intensified for many of these entities following Epstein’s 2008 criminal conviction in Florida.

The emerging picture is not of a single company but of an intricate web. This web included foundations, cross-border loans, and corporations that navigated legal boundaries. Panama served as one key jurisdiction within this framework. Banks documented these complex arrangements but often failed to dismantle them, the files suggest.

These documents add another layer to Panama’s history with high-profile financial scandals. They show how its legal structures remained attractive for those seeking discretion. The latest revelations contribute to ongoing global scrutiny of offshore finance and the movement of illicit funds. For Panama, it underscores a persistent challenge in shaking its association with secretive financial stuctural arrangements, even years after the original Jeffrey Epstein case began.